There and Back Again: A Nigerien Remittance Tale

~9 min read

While showing signs of maturity, consolidation in the remittance industry has only just begun, and there remain enormous opportunities for innovation and digitization at the first mile, the last-mile, and everything in between. This week’s Insight goes “off-road” to explore a less trodden remittance corridor to illustrate the challenges and opportunities at the remote edges of the remittance market. Zooming in from the typically aggregated views of remittance flows, what does it actually look like to get cash to some of the most remote corners of the planet today?

Step 1: Find your off-ramp provider

You’ve got some money to send home. Or maybe someone close to you does, but is rather digitally illiterate — and you, as a devoted Mondato Insight reader, are widely considered by your peers to be a bona fide digital finance expert. So you graciously agree to help get the cash from point A to point Z. But suppose you’re not sending to Nairobi, Lagos, or even Dakar — suppose your task is to get cash directly to the recipient in a small, remote village called Yekoua in Niger. This is when your headaches begin.

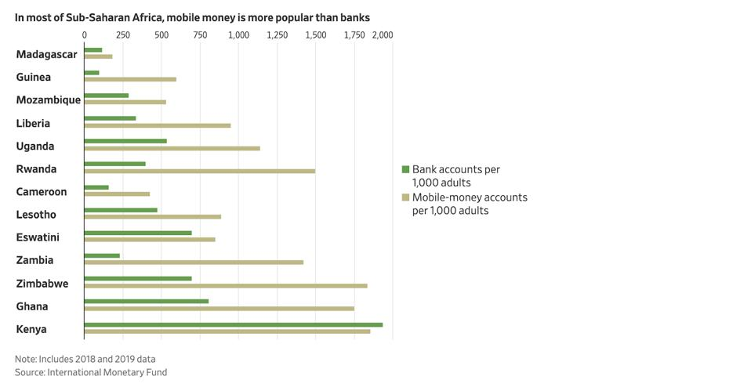

It is perhaps a trite truism that digital finance is in many senses more developed in Africa than the US. Indeed, according to McKinsey, over half of the 282 mobile money services operating worldwide are located in Sub-Saharan Africa. But while the successes of M-Pesa in Kenya and East Africa earn international adulation from think tanks and media outlets, it bears repeating that Africa is not a country. In fact, mobile money as a whole on the continent remains low and limited to specific countries. Among Niger’s 23.3 million citizens, for example, mobile money adoption is estimated at only between 3 and 9 percent of households.

Source: Forbes, December 2020

But you are undeterred. You begin by reaching out to the recipient, a young man who works in his village’s chronically under-equipped pharmacy. He has a smartphone, however, and he uses WhatsApp. You begin by asking him what the local cash-out options are in the village, and you quickly receive snapshots of available options: Al Izza, NITA, BNIF Afuwa, Zamani Telecom, and Airtel.

The first two, Al Izza and NITA, are money transfer services focused primarily on inter-Niger transfers, and though their websites advertise international transfers, these are exclusively within the French CFA Zone — a practical dead-end for purposes of on-ramping cash from your Visa credit card. BNIF Afuwa is a local bank, and not even a top tier-one — subject to an expensive and ponderously long process, given the unwieldy and complex SWIFT arrangements underpinning the global corresponding banking system, as Mondato Insight recently discussed.

The telecoms, ultimately, present the highest likelihood of success. Zamani is an Orange subsidiary and thus is likely to only accept international pay-ins from registered French bank accounts, if at all — you judge from previous experiences with French banks that this will be a uniquely frustrating can of worms and a whole other Mondato article. Airtel, on the other hand, is an Indian company operating in Africa with a more integrationist approach and thus less likely to be restricted by European banking laws. Airtel it is.

Step 2: Find a matching on-ramp provider

Needless to say, your Bank of America account cannot Zelle money to West Africa. Your first stop is to download the Airtel app. This is also a dead-end, however: the apps are offered by country, and you need a local number to activate. You’ll need to find a third-party money transfer operator with the right anti-money laundering (AML) and Know Your Customer (KYC) licensing to operate both in your country of origin and the recipient’s destination country.

Perhaps, being in the know, you first go to Monito, a remittance comparison website, and find the only recommended option for this remittance route to be WorldRemit — unsurprising, given the company’s recent rise to the top of the ‘remittance challenger’ pack, particularly for Africa. Yet you are disappointed to discover that WorldRemit’s mobile money transfers to Niger have been discontinued. You’ve been hearing good things about Chipper Cash — another-up and-coming remittance fintech recently funded to the tune of US$30 million by (former) Amazon CEO Jeff Bezos’ personal VC fund — but despite having been founded in Silicon Valley, they still don’t support cash-in from the US. Back to square one.

You could, of course, throw your hands up and go for the tried-and-true Western Union — but the fees are high and the distance to the nearest branch non-negligible for your recipient. After fiddling around with Google search parameters, you finally come upon EziPay. You’ve never heard of them before; it is unclear if they are based in Ghana, Côte d’Ivoire, Dubai, or India, but the website is populated with lots of content, no red flags come up on your quick background check of the company and its web dev/fintech Indian founders — and frankly, you’ve got no other strong leads.

“EziPay is a multi-currency service that is available from over 100 countries to more than 140 receiving ones, takes only 4 to 5 percent of the total amount to be sent and the charge fees go less as the amount is going big."

EziPay Website, 2021

Step 3: Take a leap of faith

You’ve downloaded the EziPay app, and before you can start transacting, it’s time to share some personal information. You upload a photo of yourself holding your government-issued ID, as well as a photo of your credit card with all but a few of the identifying numbers obscured, as per instructions. Within a few hours, you receive a WhatsApp message from a customer service business account asking you to confirm that you know your intended recipient “in person.” You confirm this, and you are approved. You are impressed with the alacrity, responsiveness, and ‘human feel’ of this digital verification process.

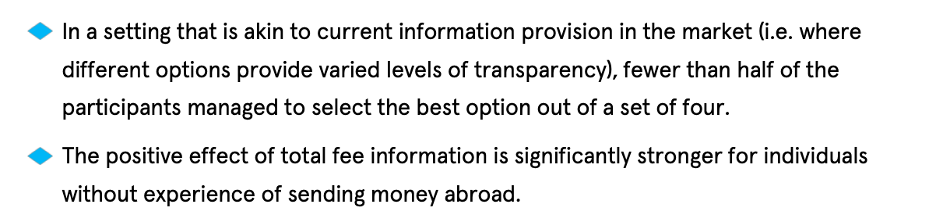

Now it is time to load your EziPay digital wallet. A lot of digital ink has been spilled on the challenges with pricing transparency in the remittance space (how much is being charged as commission? How much is spent at hard-to-see, “true” FX market rates?); EziPay’s approach is fairly straightforward. You are directed to input your intended cash-in amount to your new wallet — directly as a local-currency amount (CFA, in your case.) The fee to be charged is displayed as you input the amount and comes out to just under 3 percent of the value of the remittance equivalent to less than $200. You are reassured that your cash-in transaction is Verified by Visa; the amount on your credit card statement corresponds to the day’s mid-market exchange rate from dollars, and you receive confirmation emails from both EziPay and UBA (United Bank of Africa) documenting your transaction success.

Source: Behavioral Insights, 2018

You are finally ready to send. You ask your local recipient to ensure that the local Airtel mobile money agent has sufficient “float” to disburse your sending amount — best to avoid running into drawn out liquidity issues. No issues there, but you discover there is a cash-out commission to be expected from the Airtel agent that is not factored into EziPay’s commission. Reflecting on the embeddedness of digital infrastructures within traditional livelihoods and values for “last-mile” mobile money agents, you initiate a WhatsApp-mediated negotiation via your recipient. In other words, you have them go to the agent in person, and, prior to initiating the transaction, come to a mutually acceptable cash-out commission. This is the part of the transaction that is stubbornly non-digital: your recipient is able to leverage local Hausa negotiating norms and face-to-face interaction in a way no technology has yet to replace.

You carefully type in the recipient’s phone number, note another 3 percent commission on the transaction, and hit send. Images from your recipient of cash in hand follow shortly thereafter. For your perseverance, you managed an end-to-end remittance transaction from your credit card directly to the last-mile for just under 10 percent of total sending cost: roughly 3 percent to upload cash into your digital wallet, 3 percent to send to your recipient, and 3 percent for the last-mile agent.

Though it took only minutes to execute the transfer successfully, it took you days to find and sift through the pieces of a globally fragmented puzzle across the digital finance landscape, put all the pieces together, and monitor each step of the process. You wonder how many would-be remitters sending critical funds to their loved ones have the patience and resources to do what you just did.

On Solid Footing

Arunjay Katakam is a fintech entrepreneur, futurist, and author of the book “The Power of Micro Money Transfers.” His focus is specifically on the importance of transparency in an industry riddled with “confusion” pricing. A sense of indignation emerges when discussing the numerous obstacles, opacities, and commissions that eat at the sums of money zooming around the world in the form of 1s and 0s.

"Imagine if you had to figure out which email platform would enable you to get your message to one individual versus another. Imagine if each email you sent had a different pricing structure to it depending on who you were writing to, and that costs go higher the poorer your recipient is."

Arunjay Katakam - Author, “The Power of Micro Money Transfers"

Katakam compares this to the fee-for-send early days of BlackBerry and the explosive growth WhatsApp experienced once it abandoned its yearly subscription model and became fully free under Facebook. When considering the UN goal of reining in average remittance costs to under 3 percent, Katakam notes that the average costs of sending remittances in competitive corridors are less than 1 percent. Perhaps this augurs well for the rest of the global remittance market, which through the ups and downs of the global COVID-19 pandemic is ultimately proving more resilient than initially predicted.

For now, however, many painstaking steps remain before reaching a friction-free remittance superhighway. Small outfits like EziPay are valuable contributors to a densifying ecosystem which illustrate the power and potential of digitizing the cash-in-cash-out assemblage puzzle for lesser developed corridors, but it is less clear how scrappy start-ups, regional success stories, global payment giants, and a diverse supporting cast of regulators, integrators, and financiers all come together to keep costs low across the board. Indeed, it is precisely due to the lack of competition in less frequented corridors that money transfer operators feel free to extract more commission percentages from senders and receivers.

It is perhaps only transparency that offers us a chance at understanding these forces as they play out; that, and a fundamentally cooperative and integrative approach to technological innovation. Such might be your conclusion after the lived experience of remitting money from the United States to Yekoua, Niger, which tangibly exemplifies the otherwise heady theories regarding remittances’ local embeddedness, innovation and financial access in developing economies:

“The success of growth processes for digital infrastructures depends thus on the establishment of interoperability between various platform actors, including informal dimensions of the expanding network, but also on ‘scaling down’ as the infrastructures adapt to locally specific niches. ‘Scaling down’ makes global infrastructures ‘locally useful.’ Constructing locally accessible gateways for the global systems relies crucially on local institutional and technological resources, such as the use of local merchants and retail shops as agents to solve the last mile issue in cross-border remittances."

Daivi Rodima-Taylor & William W. Grimes in International remittance rails as infrastructures: embeddedness, innovation and financial access in developing economies

The remittance transfer from the US to the village in Niger illustrates these dynamics well; in an effort to go the ‘extra mile’ and get cash directly in the hands of the recipient, the percentage fees went to a scrappy startup and a community mobile money agent — not a global behemoth like Western Union. Furthermore, the upfront investment in time and energy paid dividends in convenience on the receiving end; no longer must the recipient organize a trip to the nearest city just to get his cash. Such qualitative elements of remittance such as ‘who gets the commission’ and ‘time saved’ are too often lost in the horse race of which African fintech can raise the most money. But for those building technologies for the long-haul, it is precisely these intangibles that matter in becoming truly embedded in the fabric of daily life for the billions living outside the capitals, metropolises, and other remittance hotspots of the developing world.

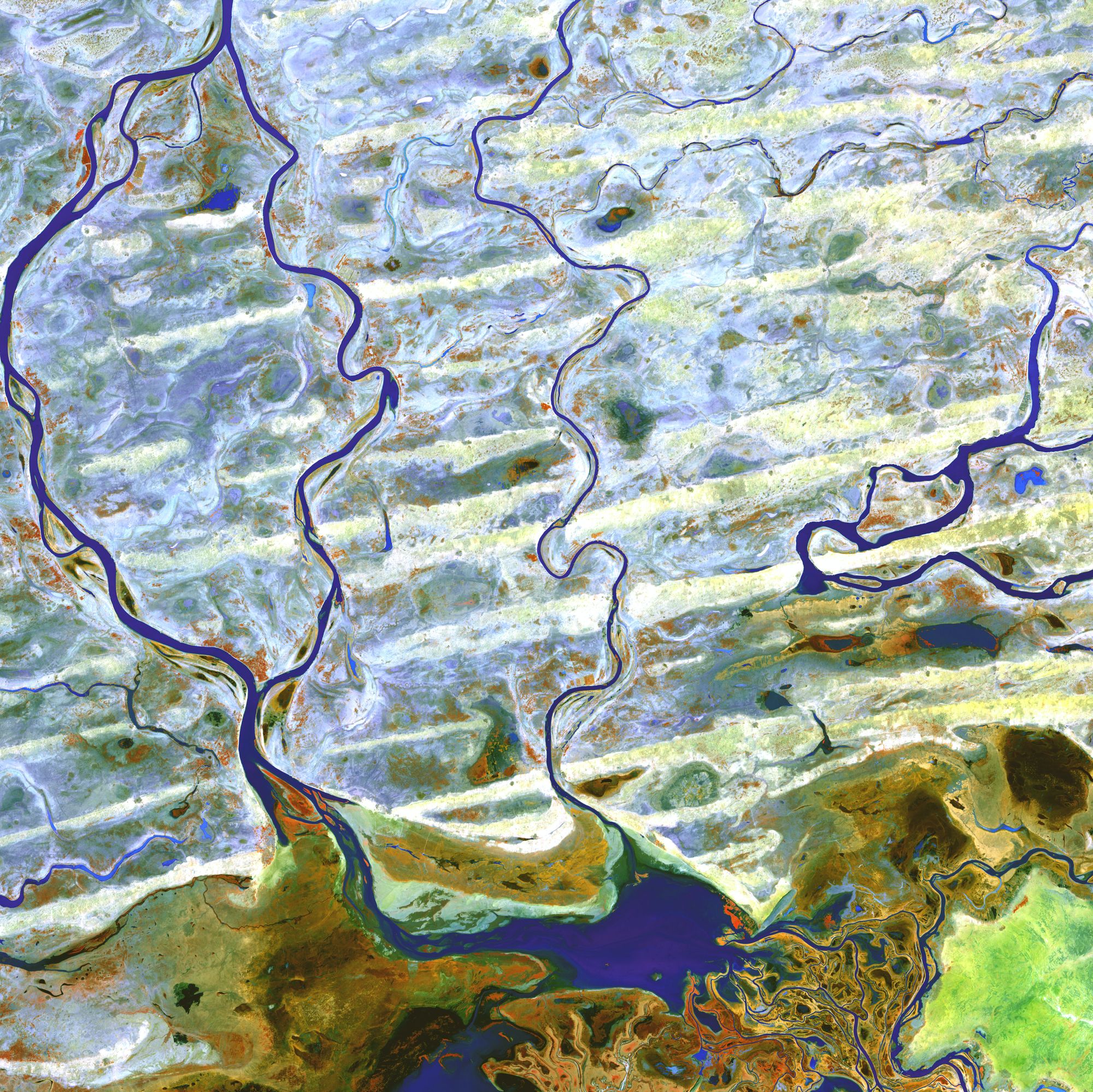

Image courtesy of USGS

Click here to subscribe and receive a weekly Mondato Insight directly to your inbox.

Is Covid the “Big Bang” of Digital Payments?

Auto Fintech: Driving the Smart Vehicle into Uncharted Territory