Betting on Chaos: Africa’s Thriving Online Gambling Industry

~8 min read

For 36-year-old Zimbabwean Charles Mpeni, a former civil servant and gambling addict, betting on horses was a harmless pastime that gave him, once in a while, ‘a bit of cash’ and some thrills. After the outbreak of the COVID-19 pandemic, however, Mpeni transitioned to gambling online to stave off loneliness. In a country where widespread use of mobile money for everyday business normalizes microtransactions, Mpeni found it easy to gamble small amounts frequently. After two years of rollercoaster wins and crushing losses, however, his spiral into financial ruin was so complete that twice he had lost a car and his job as a hospital driver, with several close relationships permanently strained.

Mpeni’s story has become common across Africa, where rapid strides in digitized betting have lured tens of thousands of new gamblers. This rapid boom has unfolded in a largely unregulated market — and the ease of mobile money transactions and gamified online platforms is pushing more gamblers in Africa to financial ruin.

From Bricks to Clicks

In its own way, online gambling is a potentially smoother path to digital inclusion in Africa than, say, gig work and the digital talent economy. Gambling requires no specialized skill, and the infrastructure needed for online gambling already exists in an ever-growing number of places in Africa. The gamification techniques often promoted by banks and financial institutions nowadays lends itself quite neatly into gambling ventures — though rather than promoting better financial practices, it threatens to do the opposite.

Before the pandemic, countries like Uganda, Kenya, South Africa, Nigeria, Ghana, Zimbabwe, and Botswana already boasted a vibrant sports betting culture, often centered around dedicated betting shops or kiosks integrated into bars and restaurants. Betting halls that dot nearly every street in cities such as Harare are often crowded especially on weekends. At these venues, colorful betting slips lie scattered on worn tables, and computerized self-help kiosks serve impatient gamblers in meandering queues amid rows of gamblers glued to the flickering LED screens for hours on end.

However, the continent's remarkable mobile penetration rate facilitated unprecedented access to digital platforms for gambling at the onset of the COVID-19 pandemic, which drove an even greater surge in online betting as land-based casinos shut down. With live sports gone from TV screens during the pandemic, the situation pushed gamblers towards new avenues.

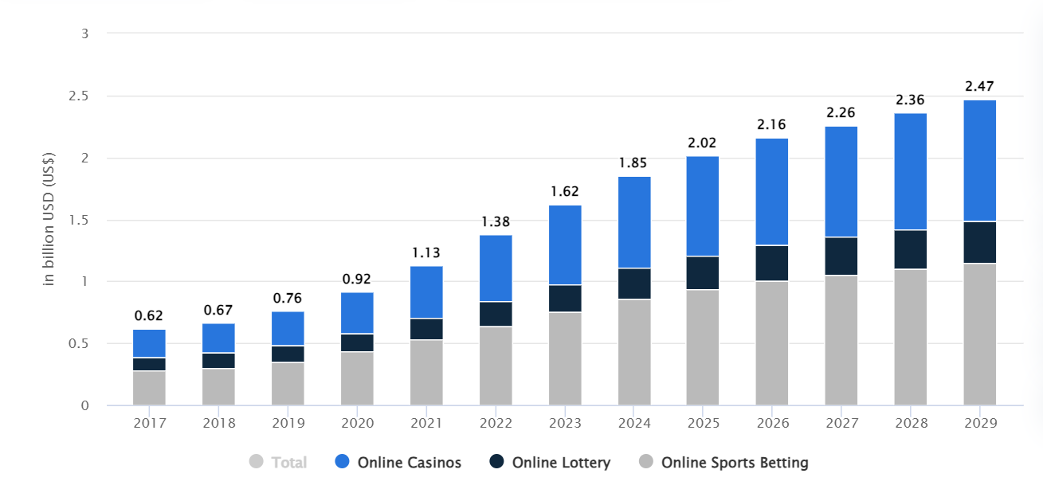

Source: Revenue Growth Outlook for Online Gambling in Africa, 2017-2029, Statista

Source: Revenue Growth Outlook for Online Gambling in Africa, 2017-2029, Statista

Statista projects that African online gambling revenue will already be US$1.85bn in 2024, reaching $2.46 billion by 2029. What has in large part driven Africa’s fintech leap forward — namely the thriving mobile money services and rapidly increasing smartphone penetration cross the continent’s youth bulge — has likewise propelled digitized gambling. Many Africans are not just young: they have some disposable income, but limited entertainment or access to traditional gambling options. Across the continent, gambling houses have opportunistically wielded fintech solutions that make it easy to place a bet using a phone. In Kenya alone, online gambling platforms, which let users play on their phones and collect winnings via mobile money, include Chezafutaa, Betway, Betin, Elitebet, Betyetu, Justbet, Easybet, Lucky to You and KenyaSportsBet.

With its entrenched M-PESA mobile money ecosystem facilitating cashless payments, Kenya is facing an exponential surge in online betting. Here, the integration of gamified elements — leaderboards, rewards, virtual sports betting and lucky number games in gaming apps — is supplementing traditional sports betting options and becoming a gateway for addiction and problem gambling, according to Nelson Bwire, project lead at Gamawareness254, a Nairobi-based NGO that combats problem gambling.

“These gamified elements and new design features seem harmless on the surface, or simply meant to heighten engagement, but they exploit psychological vulnerabilities. We need stricter regulations to limit manipulative marketing tactics and control the accessibility of these apps.”

Nelson Bwire, Project Lead, Gamawareness254

Evolving Landscapes: Diverse Paths to Regulation

Africa’s largest economy, South Africa, is the instructive template upon which many other countries in Africa base their own rules, according to Nkoatse Mashamaite, head of compliance at South Africa’s National Gambling Board (NGB). This influence extends beyond broad principles. Kenya's 2019 Betting, Lotteries and Gaming Act closely mirrors South Africa's rules regarding licensing requirements for operators, age restrictions for players and its detailed responsible gambling measures — similarities that makes it easier for operators with experience in South Africa to navigate the Kenyan market.

In South Africa, the gambling market was originally a monopoly solely focused on horse racing betting, but post-apartheid, regulations paved the way for a more diverse and flourishing industry now encompassing casinos, betting and bingo halls, and limited payout machines.

Especially during the pandemic, the transition from physical to online gambling was partly driven by new operators capitalizing on new restrictions placed on traditional casinos and bookmakers, which limited operating hours and possible casino locations while restricting late-night gambling and how casinos and bookmakers could advertise.

The progressive National Gambling Amendment Act of 2008 — and an adjusted version of the Act ten years later in the form of the National Digital Monitoring System (NDMS) — would have amended existing laws to provide comprehensive oversight for online gambling. However, political stagnation has left online gambling largely unregulated, with exceptions for sports betting and a small number of licensed online casino operators.

Despite exploiting loopholes to offer limited online gambling options through standalone casino games and independent sports betting platforms, South Africa still boasts the most established legal framework on the continent. In contrast, Nigeria presents a fragmented regulatory landscape with significant disparities across its regions. Lagos stands out with a more established framework via its Lagos State Lotteries and Gaming Authority (LSLB), whose licensing revolves around Know Your Customer (KYC) procedures, age verification, and responsible gambling practices. However, several Nigerian northern states lack clear regulations, while southern states take a middle ground, establishing licensing requirements but with less stringent regulations compared to Lagos. Regulatory arbitrage in such an online context manifests among the customers themselves. Furthermore, the lack of a clear national framework makes enforcement a tricky, if not nearly impossible, undertaking, ultimately crippling the tax collection efforts of Nigeria’s Federal Inland Revenue Service (FIRS).

Kenya’s gambling sector has a regulatory framework widely seen as outdated and limited in scope, failing to adequately address the online sphere. Recent legislative proposals tilt less towards implementing comprehensive oversight and more towards strategic deterrence, aiming for higher gambling taxes and heavier fines. Kenyan-founded Sportpesa, a major online betting player with global sponsorships and streamlined mobile betting, has faced protracted license renewal issues as a result of standing irregularities with Kenya’s taxing authority.

Source: Symphony Solutions

Source: Symphony Solutions

In contrast to more established markets, Zimbabwe's nascent gambling scene exhibits limited gamification due to the interplay of two key factors: a lack of robust regulations and the entrenched dominance of traditional betting shops — a dynamic not so different from the slower pace of financial innovation in incumbent bank-driven markets. A lack of regulatory clarity around online operations has only further encouraged local operators to maintain basic operations rather than aggressively implement engagement-targeting features or gamification.

Betting On The House

Though African fintechs are finally facing tightened regulations, regulating complex gambling products is proving to be a Sisyphean task as in-game design innovation races ahead.

“We as regulators are going to be playing catch-up for a while. For example, when one mode of gambling takes over the role of another in this fast-changing landscape, the result has been immeasurable challenges in ensuring that each new form adheres to all the set norms and standards. Rapid change has undermined regulation efforts.”

Nkoatse Mashamaite, Chief Compliance Officer, National Gambling Board of South Africa

Increasingly, online casinos offer “loot box” features, where players unlock in-game achievements, gamifying the experience and pushing the sector to realms regulators haven't yet established clear frameworks for. Such changes reflect a broader shift in Africa's gambling culture. Traditionally, gambling existed in more localized forms — card games or small wagers on sporting events within communities. Digitized forms of gambling haven't replaced the older traditions entirely, but they've built on this existing foundation and transformed it into a much more accessible activity — fueled by mobile money and more gamified platforms.

Another aspect Mashamaite is worried about is the lack of mandatory testing for African mobile gambling apps. Mashamaite doesn't explicitly state rigging, focusing instead on the lack of testing and potential for unfairness. The absence of independent verification, however, creates vulnerabilities in the system, as unfair algorithms or biased game mechanics affecting player outcomes become an increasing issue without proper testing. Such a lack of safeguards creates a breeding ground for unfair practices and leaves players at significant risk to gamble at slim odds far beyond the house edge.

This lack of oversight is particularly concerning when considering the aggressive marketing tactics employed by gambling companies in Africa. Former gambling addict Mpeni believes that regular advertising and word-of-mouth promotion both played a critical role in his transition to online gambling. Zimbabwe relies heavily on celebrity endorsements and soccer stars to advertise gambling, a trend mirrored almost everywhere, from the United States to Nigeria, where betting houses leverage their sponsorship of major soccer leagues to maintain brand awareness within a sport loved by the millions of devotees in Nigeria alone.

Falling Deeper into A Hole

But just as concerning for South Africa’s Mashamaite are the ways in which digital gambling companies from abroad are illicitly entering these African markets. Critical gaps in the regulatory framework and existing enforcement measures are allowing online gambling companies from jurisdictions with lax regulations — places such as Gibraltar, Curacao and the Isle of Man — to illegally offer their services to South Africans. Even places where online gambling has been banned, such as Sudan and Somalia, have seen digital gambling options flood the market.

Such trends highlight complications that technological advancements are imposing on regulators, who struggle to track cross-border operators that illicitly bypass restrictions — following similar patterns that came before of foreign predatory lenders flooding markets in Africa.

Regulators are now realizing the risk to the integrity of their financial systems such activities pose. Shortly after the Financial Action Task Force (FATF) greylisted South Africa for deficiencies in combating money-laundering and terrorist financing, the country’s northern Limpopo province saw crackdowns on illegal gambling with raids on taverns and spaza shops across the province.

But without timely intervention, the proliferation of AI threatens whatever efforts regulators do make. Several African regulators have warned that machine learning could be used to exploit user behavior data through game design: identifying betting patterns, preferred games and spending habits for targeted promotions, bonuses, and in-game features personalized to each gambler. Additionally, AI can dynamically adjust game difficulty based on recent wins — a "near miss" strategy that keeps players hooked.

That digitized gambling has progressed across Africa in a manner similar to the digital financial revolution itself — driven towards adoption by the same push and pull factors, and manifesting regional variations according to local characteristics, needs and regulations — should not come as a surprise. But now years into the digital financial revolution, the same patterns of risky regulatory gaps and the misuse of fintech tools that bring financial harm alongside access manifest once again an industry that risks the financial health of its customers by design. As technological innovation accelerates, the bet on fintech applications yields greater possible earnings — but worrying potential losses abound.

Image courtesy of Amanda Jones

Click here to subscribe and receive a weekly Mondato Insight directly to your inbox.

CBDCs: The Answer To Cross-Border Inefficiencies?

Brazil and India Usher In The Open Finance Era