Will The Metaverse Transform Fintech As We Know It?

~10 min read

Crypto enthusiasts and Mark Zuckerberg have one thing in common: they love the metaverse. Their vision for the metaverse, however, may look quite different — and to consequential ends for fintech and digital financial services. Envisioned as a 3D virtual world enabling users to engage virtually in socializing and virtual businesses of all varieties, the metaverse is still a long way from conceptions of a unified, fully immersive virtual world. Whether the hype ever meets reality is an open question – is it just a speculative crypto-fueled fad? — yet as investment firms and Big Tech pour incredible resources into developing these infant virtual worlds and ecosystems within them, the groundwork is underway for a dramatic transformation of payment rails and commercial relationships. Yet who will be the gatekeepers — and what the underlying financial structures subsequently look like — in this sci-fi reality-to-possibly-be remains an open question.

Enter The Metaverse

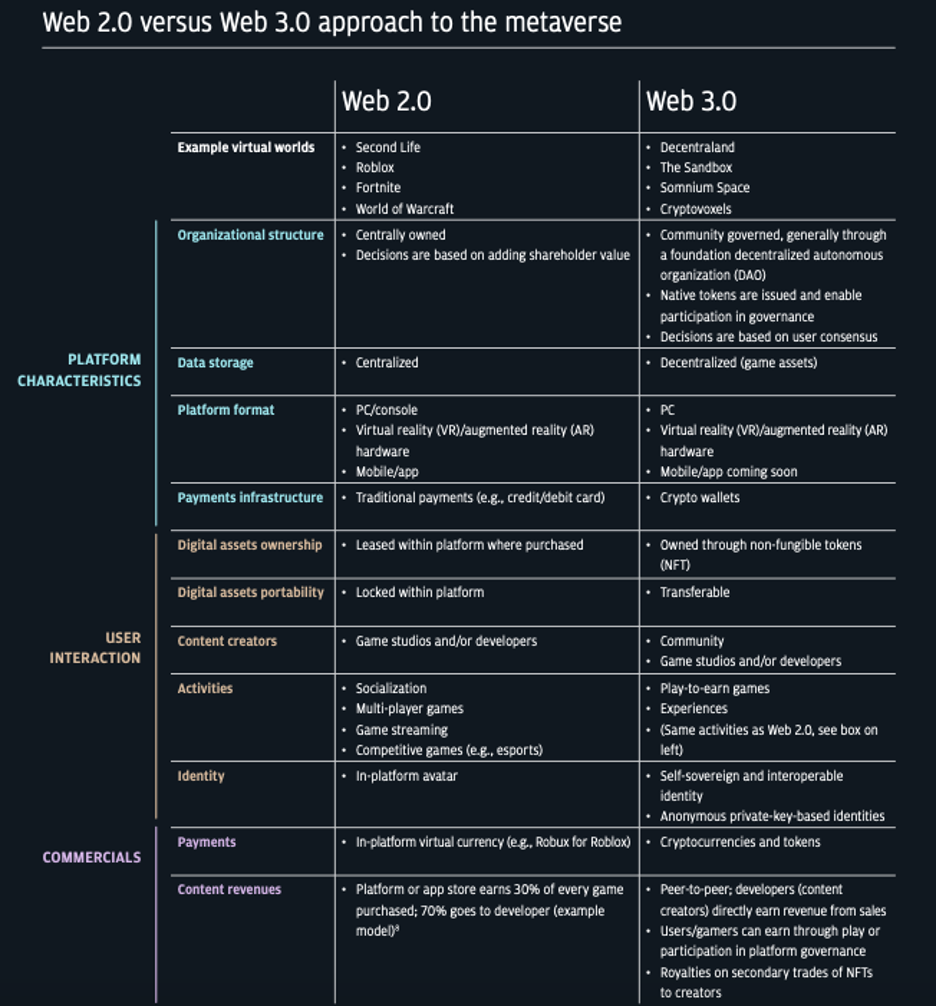

Metaverses aren’t exactly new. Precedents like Second Life pioneered self-contained virtual economies relying on real-world money and transactions for users to purchase and maintain virtual assets. Yet a Web 3.0, blockchain-based approach to metaverses unlocks dramatically more sophisticated and intricate virtual economies than what had come before.

Source: J.P. Morgan

Web 3.0 metaverses rely on cryptocurrencies minted for gameplay purposes. Though differences remain — at least initially — as to how crypto-purist these networks are and how interoperable their cryptocurrencies are with other metaverses or networks, the reliance on blockchain and cryptocurrencies upends the gaming models of old.

It starts with the inefficiencies and profit-seeking stemming from the platform gatekeepers, like Apple. As described in an exhaustive essay by VC Managing Partner Matthew Ball, though approximately $54 billion was spent in 2020 on virtual goods in the gaming sector, the ecosystem potential of virtual assets found in games like Fortnite are greatly limited both by the underlying technology and operational structures underpinning this flourishing industry.

Most importantly, Big Techs squeeze game developers out of needed revenue. The closed distribution models of app stores enable Big Techs to charge developers a 30% fee for their game-generated revenues, locking developers out if they don’t acquiesce. This has stymied the innovation and success of developers, who struggle to make a profit under the pervading system.

Alternative gateways for next-gen metaverses are yet to truly emerge, with many still reliant on app stores, yet the expectation is that infrastructures will develop to further peer-to-peer networks that currently are largely browser-based to mitigate reliance on the dominant platforms of today (a lack of common standards, however, currently force developers to choose “between impractical fees or mediocre experiences,” as Ball describes).

While Web 3.0 metaverses continue to struggle for autonomy from app stores, arguably the most dramatic innovation they present is the utilization of NFTs and cryptocurrencies to fuel its virtual asset economy. Virtual games of old rely on game-specific currencies converted from fiat, and they are non-transferrable to other virtual worlds, let alone back to fiat itself. Further, the centralized nature of these virtual economies — in which possession is really indefinite and subject to revocation — belies the idea of users possessing “true ownership.”

Not so with blockchain-enabled metaverses. Packaging virtual assets as NFTs relegates ownership solely with the user, forever, and as potentially interoperable with other metaverses. This dramatically reshapes the virtual asset economy. A single purchase is permanent and applicable across all metaverses, encouraging higher-ticket purchases, play-to-earn mechanisms, and dedicated investment in these virtual assets.

In the new gamified virtual asset structures, buying a parcel of virtual real estate for tens of thousands of dollars is no longer merely entertainment — it’s an investment, as developers create finite worlds with finite assets and collectibles that can be further manipulated and utilized as its owners wish.

While centralized forms of metaverses can assuredly utilize consumer data for even more sophisticated and invasive targeted ads, the generally decentralized nature of next-gen metaverses creates a completely different economic structure than what had come before these worlds, combining social media and ecommerce in gamified structures that empower users themselves as the principal designers and drivers of metaverse economies.

“Facebook and Google basically use advertising — they're taking indirect ways of extracting value out of the users for marketing. The future value exchange will be on purpose by the users themselves: they want to do that, and they need to give away less of their data. In Upland, we don't know anything about our users.”

Dirk Lueth, Co-Founder and Co-CEO, Upland

E Pluribus Unum?

Metaverses, essentially, are creating self-sustaining economies from scratch. How this looks differs by the philosophy and approach taken. One of the leading metaverses is Decentraland, and it embodies a purist, libertarian crypto vision for how these worlds will function. Like several other crypto-based metaverses, Decentraland is run by a not-for-profit foundation, which works to develop the underlying architecture. In Decentraland — which includes finite parcels of “land” to be sold and transacted — the still-developing society is self-governed as a Decentralized Autonomous Organization (DAO), in which Decentraland landowners are all entitled to vote to establish and alter the variety of rules governing commercial, monetary and social policies. The hands-off approach by Decentraland’s foundation is intended to give its users the ability to explore and develop use cases as they see fit.

“At the core of it, we're here to inspire the community to continue to build and create within the platform itself. So [we] develop SDKs (Software Development Kits) for landowners to deploy their own builds, and third-party developers use those SDKs to personalize something that's forever getting better every time someone deploys something… the economies of it all, if the users are engaged, can be whatever economy that they deem it to be.”

Adam De Cata, Head of Partnerships, Decentraland

In theory, this radical user empowerment in a 3D virtual world creates limitless possible use cases — hosting concerts, virtual stores for brands (selling either NFTs or as a conduit to real-life purchases), educational opportunities, immersive videoconferencing, and much, much more — developed by users themselves building on the SDKs made available.

Virtual land grabbing has exploded within these metaverses, as the scramble grows beyond individual users and towards investment firms and retailers. Andrew Kiguel, CEO of tokens.com, shifted tokens.com last year from buying crypto tokens like Ethereum to investing in virtual real estate. Tokens.com now possess virtual real estate in seven different metaverses, including Decentraland. Serving as a landlord to virtual real estate worth “well over eight figures,” according to Kiguel, tokens.com is one of many real-world companies servicing clients in the virtual economy.

Hiring traditional real estate people and tech talent to assist in the architecture and design, Kiguel seized on the virtual real estate opportunities upon realizing the finite amount of land in these metaverses. While some tenants open virtual stores selling NFTs or real-world ecommerce companions, the majority of his “tenants” utilize the rented space for virtual billboards and other forms of advertising, with fashion companies like Gucci and Forever 21 viewing metaverse properties as an opportunity to cultivate trendy brand images with young users.

While mostly dealing in fiat transactions with tenants, Kiguel says tokens.com also sometimes brokers deal with tenants to get a cut of their revenue.

“We want to be a one stop shop for brands who want to enter the metaverse. For them, it's sometimes easier to just pay us in fiat and have us do all the work to design the architecture. With other groups, we have a portion of NFT sales. So for some of the brands we're working with, we get anywhere from five to 25% of whatever is sold — which can be very rewarding.”

Andrew Kiguel, Founder and CEO, tokens.com

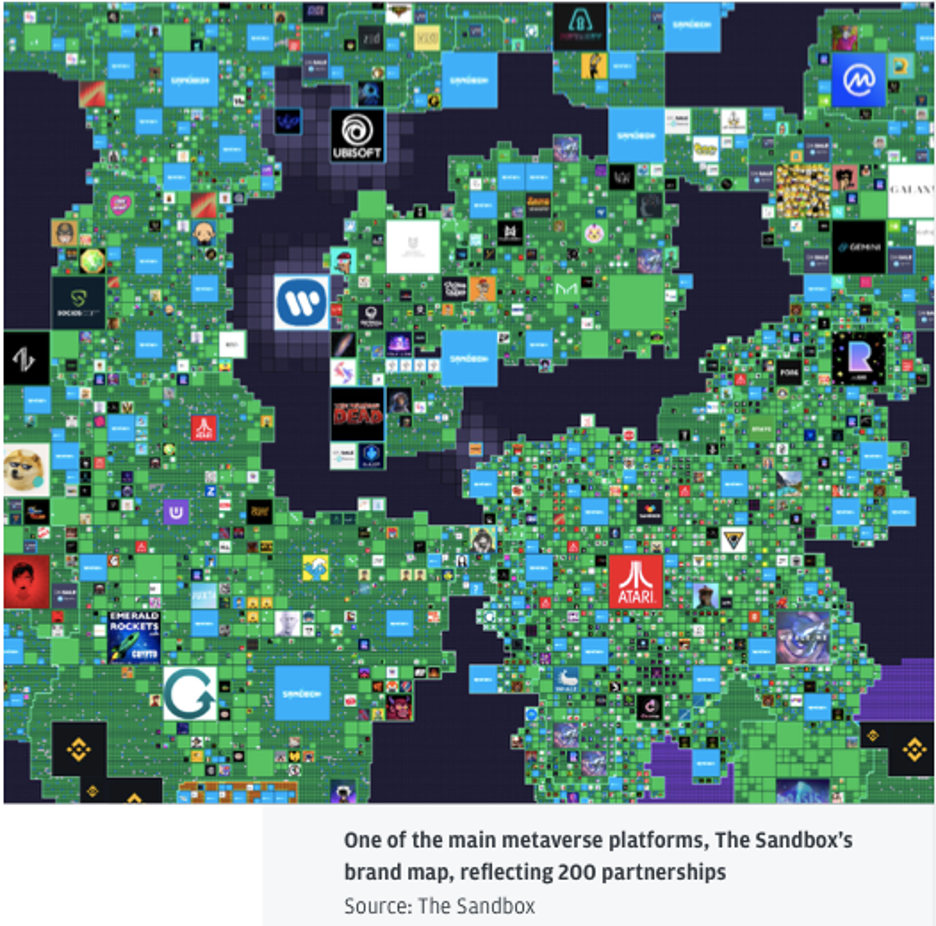

Strategic partnerships undergird much of the growing metaverse economies and the panoply of potential use cases they offer. The rush by leading brands and retailers to get an early piece of finite land marks a remarkable turn to crypto that may have been difficult to envisage not long ago. While it may be foolish for banks to go so far as to have virtual bank branches, excitement around VR figures prominently in the future plans for many banks. In December, Bank of America’s managing direct of research went so far as to proclaim the metaverse is where “we’re going to start using cryptocurrencies as currencies,” envisioning unprecedented collaboration between traditional payments providers and cryptocurrencies.

Yet creating virtual economies based upon cryptocurrencies can be — surprise, surprise — volatile, especially in their early going. Although MANA, the cryptocurrency serving as Decentraland’s form of crypto, was one of the ten best-performing cryptocurrencies in 2021, MANA and the pricing structures undergirding Decentraland’s economy remains subject to volatile swings that can only be corralled by the (hopefully) do-right forces of Decentraland’s DAO.

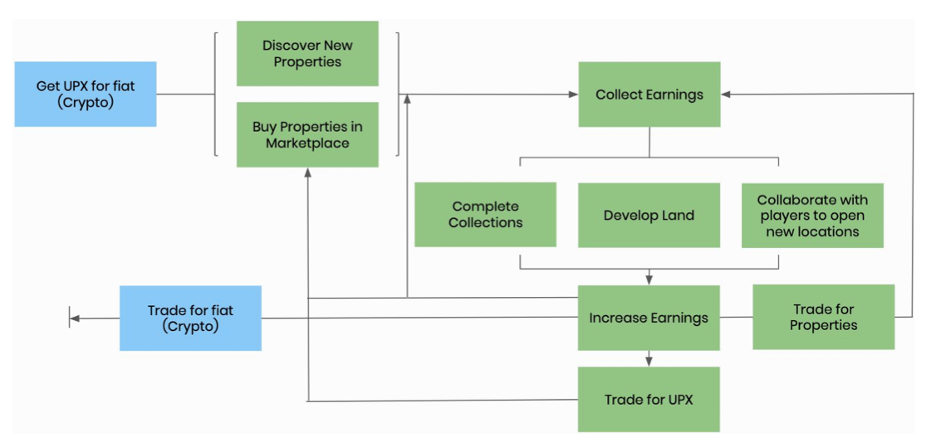

Upland is another metaverse that at least in its early stages is taking a less doggedly decentralized approach. Inspired by Monopoly the game, Upland at its core engages users to buy and transact virtual real estate modelled on real-world real estate. Its currency, UPX, Is pre-inflated so $1 equals 1,000 UPX. Lueth, an economist by training, views the centralization of monetary forces in the early going as necessary to stabilize the currency and prevent corruption by a group of bad actors. When the platform reaches mass adoption and the economy stabilizes, the oversight structure will also likely revert to a non-profit foundation with community decisions made by an Upland DAO.

Unlike Decentraland, which is entirely crypto-based, fiat is used to cash in and cash out of Upland’s UPX-based economy. By simply owning virtual land in Upland, owners receive a 14% annual yield on their virtual properties, revenue which is derived from a “Community Pool” funded by a 5% transactional tax paid between buyers and sellers. With over 60% of its users not owning NFTs outside of Upland, Upland serves as more of a user-friendly gateway for novices to engage in blockchain-based worlds.

According to Upland’s Lueth, who is an economist by training, Upland’s vision is to create a “full entrepreneurial economy.” The entrepreneurial economy is founded upon four production factors: land, capital, labor and entrepreneurship. Player-owned shops are founded on certain parcels of purchased or leased virtual land, where entrepreneurs can sell NFTs, digital assets or as a portal to real-life ecommerce, as well as performing services like upgrades to a user’s virtual car or redesigning their virtual property — labor which can be contracted to supporting third-parties who build on top of Upland’s virtual world utilizing Blender, a free and open-source 3D computer graphics software tool set.

Source: Upland Game Loops, Upland White Paper

UPX is a closed-loop digital token, yet the architecture allows in the future for interoperability with currencies from other metaverses. The actual value bestowed to these metaverse digital tokens invites the possibility for the real and virtual worlds of commerce to merge, disrupting payment rails as we know it.

“When it comes into real life, things are going to get blurred…. I clearly see that our token could be used to buy goods: you don't need to wait 20 minutes, no transaction fees, and so on, we could easily do that technically speaking. It's just the regulatory stuff you have to overcome.”

Dirk Lueth, Co-Founder and Co-CEO, Upland

Utopia, Dystopia — Or Neither?

For all the grand vision, it’ important to remember that metaverse economies are still in their infancy stages. The looming entry of Big Techs like Meta has the potential to disrupt the relatively decentralized, interoperable nature most early metaverses employ at least philosophically, though mystery still abounds regarding the nature and architecture undergirding Big Techs’ metaverses-to-be. Meta’s ownership of Oculus — which dominates the VR market currently — is raising concerns that Meta is replicating the app stores and previous gaming systems’ model to tilt payment rails in their favor and prevent the interoperability of gaming currencies and virtual assets as evangelized by independent metaverses.

Regulation to come may play a vital role in the shape of metaverse economies and transactions. If cryptocurrencies are banned as instruments of financial transactions, does this include virtual asset transactions and the virtual businesses driving these diverse digital products and services? Or, on the flip side, will the proliferation of cryptocurrencies in metaverses — and the suddenly keen involvement of major retailers and firms in such transactional spaces — encourage an easing of regulatory stances towards crypto?

Leading metaverses already are seeing impressive growth in users and commercial activities to set these nascent spaces on a course of reckoning with payment rails and regulators alike. According to Lueth’s estimations, Upland has roughly two and a half million registered users and 200,000 virtual land owners so far, with about 100,000-150,000 daily active users; a year ago, Upland saw approximately 15,000 or 20,000 daily active users. Decentraland hit over 530,000 unique users last month compared to about 30,000 unique users one year ago, according to De Cata.

No one can know if these impressive growth rates will continue towards the mass adoption rates Lueth envisions of 40 million users — and the truly collaborative, decentralized platforms the vision entails. The potential for the metaverse to encompass essentially all the social media, gaming, commercial and digital services that the Internet currently provides for allows for massive estimations of metaverses’ market potential, ranging between $700 billion by 2027 and up to $8 trillion, according to Morgan Stanley.

All of this is far from guaranteed. The question remains whether the metaverse indeed serves as a catalyst for the mainstreaming of cryptocurrencies, or whether virtual assets will actually appreciate over decades to fund a person’s retirement as users hope — or whether the incursion of Big Tech and Big Brands takes the libertarian ethos of metaverses down some dark, corporatized paths. The Internet, after all, was also an innovative free-for-all full of creativity and limitless possibilities in its early stages, too — only for that promise to be corrupted by commercial and governmental interests as time went on. If the metaverse does actually come to replace Web 2.0, will it follow similar courses of maturity marked by market manipulation driven by powerful interests?

In such considered scenarios, the decentralized, blockchain-driven architecture of metaverses will come into direct conflict with the moneyed interests fueling much of the early land-grabbing seen among metaverses. Can Big Tech overwhelm the power entrusted to metaverse DAOs? It is all still too early to know if the hype will ever approach (virtual) reality, let alone what that mainstreamed virtual reality will look like in its market shape and transactional character. Yet if the promise of metaverses is indeed fulfilled, what is sure is that payment rails and how we fundamentally understand ownership and commerce will be radically different moving forward.

Image courtesy of Michael Dziedzic

Click here to subscribe and receive a weekly Mondato Insight directly to your inbox.

Greece: The Digitization of an Economy Left Behind

Central Bank Digital Currencies: What Are They Good For?