Africa’s Social Commerce Runners: Raising The Floor, But Lowering The Ceiling?

~6 min read

Social commerce is making inroads across Africa, propelled by stronger cross-border trade corridors that are helping to plug local supply chain gaps. Amid lingering hitches to the continent’s social commerce ecosystem — chief among them high costs of transportation and disjointed supply chains — a new and pivotal enabler is emerging: the “runner.” The runner bridges the gap between fractured social commercial spaces and real-world complications on the ground, a facilitator that brings together the various players in social commerce and across the cross-border supply chain to compare prices and facilitate the movement of supplies as well as payments. The question becomes whether they signify an intermediary step in what will eventually be full, inclusive digitization — or whether they merely improve the efficiency of old and financially excluded processes.

Hit The Ground Running

Such changes are taking place within a rapidly evolving cross-border trade sector in Africa, as e-commerce and social commerce players tap into intra-African trade projected to top $3 trillion under the Africa Continental Free Trade Area (AfCFTA).

The African social commerce runners originated at the onset of the pandemic, when traders were unable to travel. With lockdowns and other pandemic-related restrictions nearly grounding economic activity, the runners became popular facilitators of social and informal trade. The runners helped the mostly informal regional traders procure stock across borders, facilitating transportation and also acting as a payments support mechanism for the sector.

Post-pandemic, runners have continued to offer the service, with goods sold informally or to social circles of traders. Jacob Phiri is one such facilitator for cross-border traders offering social commerce in the southern Africa region. He traverses the streets of Johannesburg daily, procuring supplies for traders’ inventory, comparing, and compiling price catalogues and liaising with transporters to ferry the goods to Zimbabwe, Zambia, and Malawi. The inventory ranges from electrical appliances, clothing, and school accessories to hardware, among others. The runners’ clients — essentially informal traders who also market their trade and goods on social media — use platforms such as WhatsApp Groups, Instagram, and Facebook to connect with customers, thereafter contracting runners to do the intermediary logistical work.

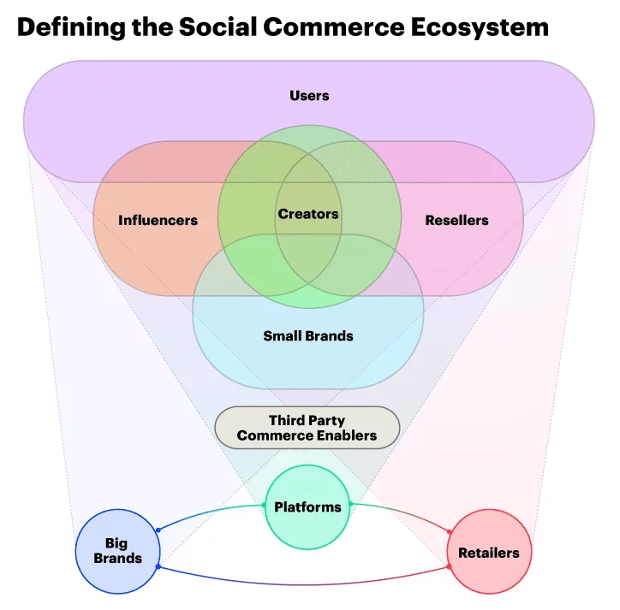

Source: Accenture

As a runner, Phiri pays for the goods using his bank card, and over several days, he organizes to load up goods onto transporters for dispatch to Harare in Zimbabwe, Lusaka in Zambia or Maputo in Mozambique. His clients — small-scale to medium-sized traders in South Africa’s neighboring countries — pay him a fee through cash payments, also remitted informally and sometimes through deposits into his bank accounts in their respective countries.

Essentially, Phiri and numerous other runners like him are a kind of trade facilitator in southern Africa, providing logistics, payments and price comparison services to informal traders. Coordination comes mostly through social media platforms that allow for video calling, though their advertising still extends to trading catalogues as well.

Roadblocks Ahead

As the runner proves pivotal in boosting informal trade and social commerce across the region, it’s contributed to keeping payments cash-based while keeping large payments outside formal channels and often unaccounted for in formal statistics.

Nonetheless, as banks and fintechs largely shy away from the informal nature of Africa’s social commerce sector, individual and small-scale payments facilitators, acting as “payment runners,” have mushroomed and blossomed.

Typically, a trader deposits money into the payment runner or the trade runner’s account in their home country. The payments facilitator, who is usually the trade runner or a separate payments runner, completes the transaction on the social merchant’s behalf in the other country through cash payments or through bank cards belonging to the runner.

“Sometimes I use cash for the payments of the goods here in South Africa because I get cash from the traders in Zimbabwe and Malawi. But there are also times that I use my South African bank cards. My job is to make sure I process the payments on behalf of traders. All they do is make payments into my accounts in their home countries or send the cash through bus drivers or transporters.”

Jacob Phiri, Informal Runner, South Africa

While traders in Zimbabwe and Zambia say this area could benefit from wider digitization offering faster, cheaper processing and settlements, fintech and payments start-ups have yet to really tap into this arena. Limited interoperability and currency volatility has made it difficult to achieve a viable business model in processing social commerce payments.

The newfound system of interconnecting runners solves some of the complexities and delays around cross-border payments, but efficiency through such informal means inherently is limited. Beneficiaries of the AfCFTA, like PAPSS, figure to feature prominently in making a transition towards safe, fast and convenient cross border payments...

In the interim, informal runners fill the gap as trade grows.

“I pay into my runner’s account here, and he pays for me the equivalent in South Africa and delivers the goods. I can’t use the banks because they are slow and they charge a higher fee. [And] I only have to pay the runner a commission for his work.”

Marylyn Adams, Informal social commerce trader, Lusaka, Zambia

Ahead Of The Pack

While cross-border social commerce has largely remained informal in southern African countries, domestic social commerce in African countries such as Egypt, Kenya and Ghana is becoming more formalized through start-ups. This has manifested in examples like Catlog, a Nigerian social commerce start-up offering vendors a simple way to create an online store on its platform. The platform allows vendors to list their products and create a custom link on social media, with deals finalized on WhatsApp. There’s also Tendo in Ghana, which enables sellers to source their products and resell them on social media platforms while facilitating payments via its mobile application.

Source: Daba Finance

Such start-ups are the early signs of a social commerce ecosystem beginning to coalesce, with figures suggesting a 70% growth rate in the social commerce industry in Africa and the Middle East last year to reach a projected $8.9 billion in 2022.

This popularity comes with increased uptake and usage of social media platforms across Africa, as smartphones proliferate and sellers prioritize business on the most used platforms. According to Ahmed Shikha, co-founder of Egyptian social commerce start-up Brimore, In Egypt, the organized ecommerce market is well-integrated with social commerce already, capturing 2.5% of the whole retail market and growing rapidly.

“Unorganized ecommerce is around $10 billion in size…[and there is] a big opportunity to organize these kinds of transactions.”

Ahmed Sheikha, Co-Founder, Brimore

Brimore works with 75,000 resellers to move 800 products from manufacturers in Egypt, helping them upload their ware onto the social media platforms of the start-up’s resellers. Buyers — mainly from the social circles of the resellers — make purchases and payments through the social media platforms.

These early digitized efforts at social commerce enable Africa’s domestic social commerce scene to assume different formats, with more focused targeting of particular social groups. Tushop is one social commerce start-up from Kenya that caters to community group purchases of groceries. The platform works with community leaders who aggregate neighbors’ orders to deliver them door to door — a model that aligns local digital trends with community traditions in a similar vein as SACCOs.

The Race For Cross-Border Options

In spite of these cases of domestic progress in social commerce, the formal integration of social commerce beyond borders remains notably absent, as difficulties in cross-border digital payments persist.

While Big Tech titans such as Amazon, Google and others are able to utilize major payment companies such as MasterCard and Visa to settle cross-border payments, local social commerce vendors still lack seamless cross-country digital payment options. Social commerce traders complain of lengthy delays in transaction settlements when going cross-border.

This hearkens to the fact that for all the years of digital talk, cash still remains a primary medium of exchange for trade and social commerce across regional corridors and frontiers of trade — and with it all the related risks and uncertainties such as exchange rate losses and theft.

Carlin Wicomb, Chief Commercial Officer for EFT Corporation, which runs digital payments solutions services in various southern African countries, concedes that “people still love having cash in their hands” in Africa. Alongside its cultural and historical underpinnings is the reality that cash remains a faster and more seamless payment medium, if with complexities for moving large sums of money across borders.

“The most important aspect for many people is the ability to move cash and access it; the moment you say the cash will be converted at the other end, you lose market share. Everybody wants cash.”

Carlin Wicomb, Chief Commercial Officer, EFT Corporation

Until the disjointed cross-border payments situation, volatile currency and inadequate financial inclusion improve, pandemic-era innovations like the social commerce runner won’t go away. Such innovations improve the efficiency of systems past, yet whether they serve as a bridge to a fully integrated, digitized social commerce payments ecosystem in the future — or a crutch impeding end-to-end digitization — remains to be seen. Expanding payment rail opportunities for informal sectors will be crucial in overcoming these barriers.

Image courtesy of Rami Al-Zayat

Click here to subscribe and receive a weekly Mondato Insight directly to your inbox.

Cross-Border Integration and The Future of Frictionless Finance

ChatGPT: The Challenges And Opportunities Coming To Financial Services