Cross-Border Integration and The Future of Frictionless Finance

~8 min read

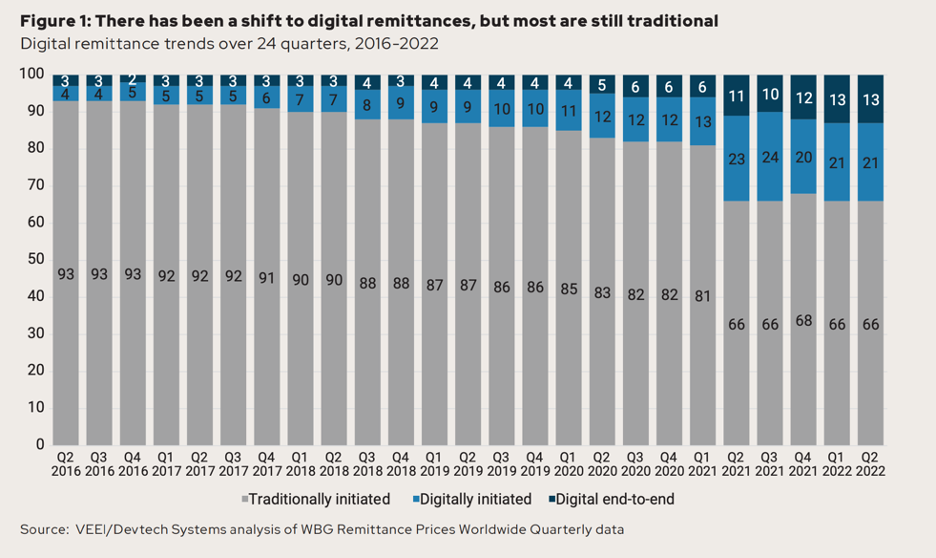

As 2023 gets underway, it is still not clear whether the shots of digitization induced by the pandemic will have a lasting impact on the remittance channels millions of migrants around the world employ to reach intended beneficiaries. Indeed, innovations in cross-border remittances lag significantly behind other segments of the digital payments space, principally due to the additional complexities of navigating technical and political borders sustainably and at scale. Yet a slew of back-end players has been at the job for over a decade connecting cross-border corridors into more regionally integrated financial hubs, and more are poised to join their ranks. What can inflection points in the vertical integration of cross-border payment infrastructures tell us about the future of frictionless digital finance?

Frictionless Borders: A DFC Utopia

What might the future of cross-border finance look like for those at the base of the economic pyramid? The answer is simple: the digital finance utopia is one where sending money is as simple and cheap as sending information. Global trends indicate that the gap between these two distinct yet related use-cases should be narrowing fast, principally due to the decreasing costs of information and communications infrastructures.

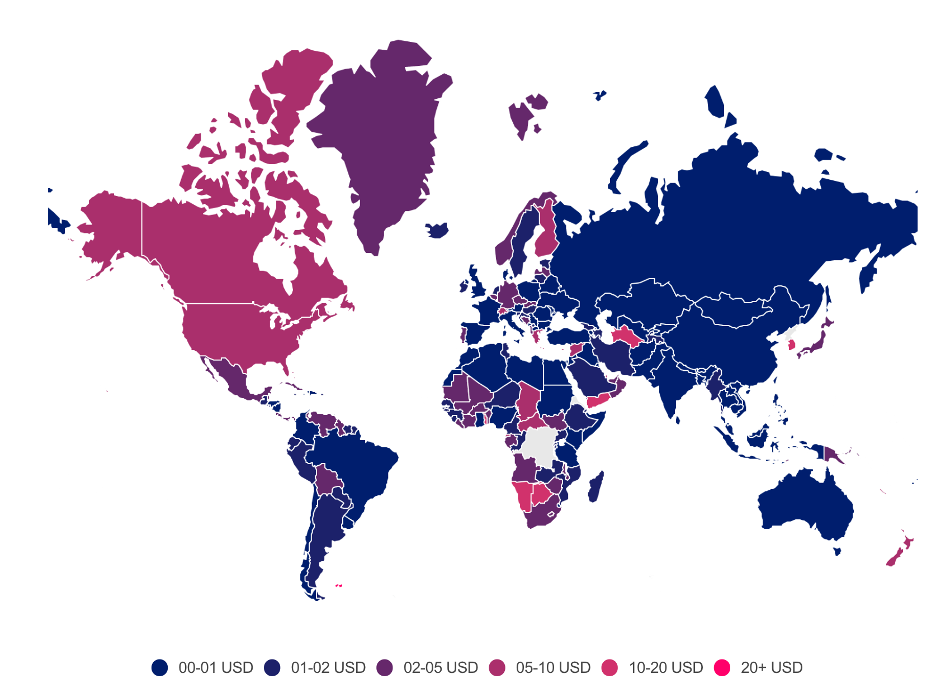

To wit: data costs are dropping across the world, though unevenly. Recent research highlights significant drops in data costs across Africa’s most expensive markets, with year-on-year drops in Malawi from $26 to $2 for a gigabyte, $23 to $2 in Chad, and $50 to $10 in Equatorial Guinea. The chart below reveals the global prices for 2022:

Source: cable.co.uk

Smartphones and smartphone-like devices, for their part, continue their inexorable march towards ubiquity, with 4G connections set to overtake 2G connections in Africa sometime this year. And mobile network coverage continues to significantly outpace all other forms of critical infrastructure services in coverage and cost improvement by partnering with tower operators and energy service operators to keep service uptime at close to 100%.

From this critical topsoil of information and communication coverage — affordable data and devices paired with accessible tower coverage — the seeds of mobile money take root, and with them, a type of formal commercial legibility in the form of user accounts. Such digital identities, with their AML and KYC requirements and their mobile money platform functionalities, act as the last-mile link that onboards even the most remote farmer to the global remittance rails that, collectively, represent a global ‘assemblage’ of local networks and global trunks.

Taken together, the distinct pieces of this global puzzle could make it possible for nearly any human on one end of the planet to transact with one on the other, instantly and at marginal cost. In this digital finance and commercial utopia, the more than 200 million African WhatsApp users today could just as easily send a banknote as a voicenote.

Yet that future is not today. A recent report by Visa Economic Empowerment Institute estimated the average cost of remittances at approximately 6% of the total sent, with the average cost of cash-funded remittances averaging slightly higher at 6.5%. Consider as well that this figure is for those who can actually figure out which corridor operator connects the various ‘on-ramp’ options to the desired ‘off-ramp’ — a byzantine endeavor requiring not just digital literacy but veritable prowess. The fact remains that the global infrastructures facilitating payments have not yet hit an inflection point in terms of financial inclusion and usability in Africa, where 80% of commercial cross-border transactions are routed halfway around the planet to be processed, mostly through the US or UK before returning to the continent.

Fixing The Cross-Border Financial Plumbing

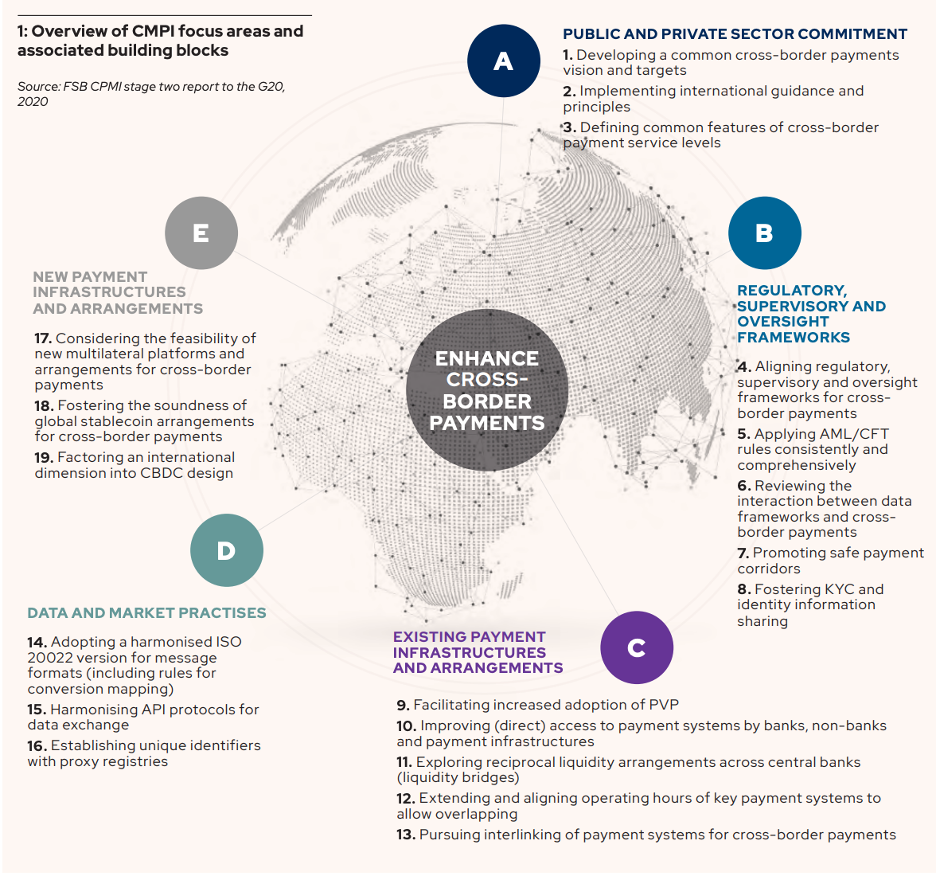

In 2020, the Chair of the Bank for International Settlements Innovation Hub characterized cross-border payments as the “forgotten corner of the world’s financial plumbing.” Key challenges to the simple vision of a seamlessly integrated network of local on-ramps and off-ramps mediated by global rails can be summarized by technological interoperability and regulatory harmonization — two concepts on which tomes can and have been written about in regards to financial inclusion.

Source: OMFIF Future of Payments 2022

A recent report on the Future of Payments produced by the Official Monetary and Financial Institutions Forum, an international consortium composed of key financial players like SWIFT and Visa, lays out a few of the potential pathways towards a less-bordered and regressive payment system. An emerging trend can be observed in the regional approach, where aggregators at the ‘meso-level’ of payment interoperability build functional assemblages at the multi-country level, building on the organic interoperability of payment corridors linking neighboring countries. This ground-up approach — in contrast to the white papers touting digital currencies, whether Central Bank or Silicon-Valley backed — has resulted in the emergence of a number of back-end integrators whose eventual merging could conceivably lead us to Digital Finance Eden.

The critical element of these payment systems is that they are connectors between intercountry networks and global networks; in this sense, they are more ‘back-end’ than anything. They include players like MFS Africa, TerraPay, HomeSend, Thunes and PAPSS, each of which are active in dozens of countries each. What distinguishes these players from more consumer-facing remittance providers is that rather than target and compete for market share along the juiciest remittance corridors, these actors sit one level above, focusing on the connecting technologies that aggregate groups of corridors. This enables back-end integrators to amass a scale and diversity of on-ramp and off-ramp possibilities heretofore never seen.

In a sense, these are the B2B equivalents of remittances’ more visible B2C plays: those that offer P2P services. These back-end players are perhaps lesser-known brands to the ultimate beneficiaries, but they are clearly succeeding at building a certain scale that gets us closer to the vision of a properly connected payment network for African financial flows.

A recent AfricaNenda report on the needs of SMEs transacting cross-border dives a bit deeper into this unique ecosystem of payment aggregators, which gives a sense of the scale and dynamism happening at the crown of the cross-border canopy. According to AfricaNenda, MFS Africa, one of the largest of these cross-border back-end players, connects over 320 million mobile money wallets. Thunes, for its part, has built up its mobile money account deposit capabilities to a whopping 1.5 billion connected, along with 4 billion bank accounts and over a billion cards in more than 30 countries. TerraPay, active in 24 global markets, focuses on low-value payments and works with Visa, while HomeSend partners with MasterCard to serve clients in over 100 countries.

As these major players ride regional approaches to financial integration, a number of smaller B2B players are following their lead, but with different ambitions: rather than compete for scale at the regional level, they specialize in B2B use-cases. Such players like Transfy, ClickPesa or TransFast focus on streamlining cross-border business, with options including real-time transaction monitoring, as well as front-end solutions such as apps for remittances or business portals for payroll and vendor payments.

Source: OMFIF Future of Payments 2022

Taken together, what we are witnessing is a potential step change in the ease of doing commerce cross-border, with an emphasis on the markets that — while first to digitize finance at the last-mile — still suffer from the worst effects of border friction for professionals.

The Congolese Case

The consequence of this increased regional vertical integration and use-case specialization is the increased commodification of cross-border functionalities. One company benefiting from such commodification is Premise, a San Francisco-based company focused on offering rapid and scalable sentiment analysis among target emerging market populations. With payment routed through whatever options (e.g., mobile money, PayPal, cryptocurrency, etc.) are allowed in a country, such use-cases are only possible thanks to back-end integrators that make the sending of even small amounts of money to various countries a manageable process rather than an interminable headache.

At the last-mile, such solutions open much-needed avenues for global sources of finance to “touch down” — that is, be deposited in a local account with cash-out options. The litmus test for how inclusive such solutions wind up being can best be observed in the extreme cases, as in geographies like the Eastern Congo or Somalia, where the challenges are more than just logistical. AML & anti-trafficking regulations complicate the frictionless flow of finance to these areas, poignantly illustrated by recent reports of large financing flows from Texas to militia groups in South Kivu. This helps illustrate why it is easier to send cash from a dumb phone in neighboring Uganda than it is from a US debit or credit card.

In eastern Congo, mobile money operators like Airtel and Orange as well as local fintech companies are already hard at work implementing the technical integration of local systems with back-end providers like MFI Africa, whose reach seems to expand quietly yet inexorably to all corners of the continent. Researchers and provincial health departments are interested in the digitization of processes like salary payments, emergency disbursements and e-Health more broadly,salivating at a huge opportunity for improved efficiency along a particularly stranded value chain.

Standardization Cometh

Against this backdrop of a thickening continuum of integrators, the global cross-border finance market is set to undergo a significant transformation in the coming years as standardization and adoption of ISO 20022 takes hold. This new standard, developed by the International Organization for Standardization (ISO), is designed to improve the efficiency and effectiveness of financial transactions by providing a common format for the exchange of financial data.

One of the key changes expected from the implementation of ISO 20022 is the increased automation of financial transactions, along with increased transparency and security — and ultimately, lower costs. These benefits accrue thanks to the standard's use of a common ‘language’ for describing financial transactions, which will make it easier for financial institutions to process and understand the data they receive, in turn reducing the need for manual intervention.

Financial messaging provider SWIFT predicts that in the coming years, ISO 20022 will be the de facto standard for high-value payment systems of all reserve currencies, supporting 80% of global volumes and 87% of value of transactions worldwide by 2025. JP Morgan describes the next few years of this process — “possibly the largest change program the payments industry has ever undertaken” — as an “awkward migration period”. It remains to be seen how well the ‘whales’, movers, and shakers of digital finance adapt to this transition and how deeply its impacts are felt and leveraged along the deepening stack of cross-border integrators, their corridor partners and end-users.

What could result from these convergent trends of cross-border back-end integration and a sea change in the standardization of the financial language constituting cross-border payment plumbing? Only time will tell, but the next few years will offer a glimpse into a potential future much closer to a digital finance Eden than today’s Tower of Babel-like system, with its fragmentation, delays and intermediate costs. The ultimate beneficiaries of this evolution are, first and foremost, the financially marginalized, for whom mobile wallets represent a critical lifeline through global or local economic shocks like the pandemic we emerge from. But beyond simple survival, this evolution also represents the chance for those at the bottom of the economic pyramid to realize dreams of economic advancement and commercial flourishing — all made possible by a less-bordered future of digital finance.

Image courtesy of Nathan Queloz

Click here to subscribe and receive a weekly Mondato Insight directly to your inbox.

What’s Missing in Affordable Housing Financing

Africa’s Social Commerce Runners: Raising The Floor, But Lowering The Ceiling?