Emerging Market BNPL: An Opportunity for Growth and Inclusion

~8 min read

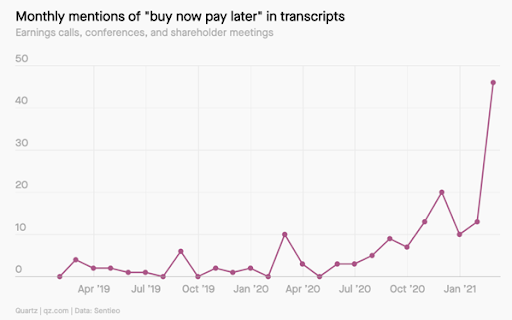

As retailers continue to explore ways to incentivize customers to purchase more online, and as fintech providers look to disrupt the US$8 trillion credit card industry, Buy Now Pay Later (BNPL) services have only increased in popularity, dominating headlines as the new “buzzword” of digital finance. Since the Mondato Insight explored the uptick of BNPL services just six months ago, the service offering has been the focus of public discussions, debate and investor interest, up dramatically from 2020.

Source: Quartz, 2021

Though the offering is essentially a slick digital layaway product, the BNPL industry is expected to grow to 15 times its current size in the next few years to account for US$1 trillion of annual merchandising volume, creating a race for fintech providers to partner, expand and claim their territory. The laundry list of BNPL entrants has quickly expanded from the original providers like Affirm, Afterpay and Klarna to welcome facilitators like Mastercard and Stripe looking to capitalize on the opportunity by enabling their merchant networks, as well as retroactive providers like American Express and Chase that have begun to offer more flexible payment options. But still, little has been said about whether BNPL providers intend to expand to emerging markets, where e-commerce is growing and Gen Z and millennials are also looking for non-bank alternatives for credit and loan products.

This week’s Insight explores the opportunities and challenges for BNPL applications across less developed markets, and whether BNPL could present an onramp to financial inclusion and literacy among younger generations.

The Emerging Market Context

Experts posit that the BNPL trend has been fueled by lower penetration of credit cards among millennials, coupled with the desire to consume the same amount as previous generations — but with less disposable income than their predecessors to do so. Without requiring credit checks or underwriting, BNPL makes it easier to offer loans to those who may be outside of the traditional financial ecosystem. BNPL is also often used for smaller transactions, with many service providers offering loans for purchases as low as US$10. These compelling explanations for BNPL’s recent popularity and success would also seemingly apply — if not more so — to the emerging market context.

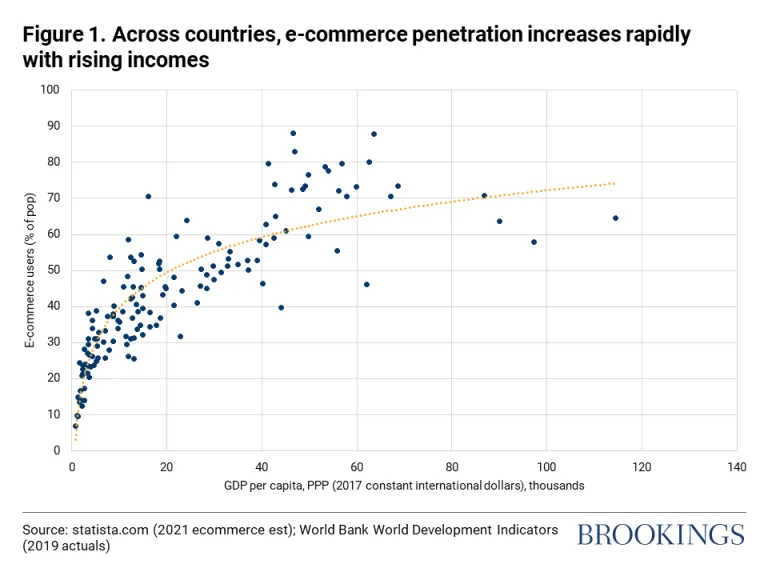

The COVID pandemic has accelerated emerging market e-commerce penetration, which is only expected to grow dramatically as incomes increase with economic development. In Asia-Pacific alone, e-commerce is expected to grow 17.6 percent annually to US$3.6 trillion by 2023. And as demand for e-commerce rises, many will seek alternative payment and loan methods to make these purchases, as the majority of the world’s unbanked population with little or no access to credit resides in emerging markets.

Many see BNPL as the answer to merchants looking to meet e-commerce demand and alleviate financial pressure for their customers. And even though consumers were found to spend more on average when using BNPL, there is still debate whether BNPL offerings in developed markets are increasing sales from new customers, as intended, or merely trending as a payment preference for those that would normally use traditional payment options.

Though BNPL is seemingly a niche market within the digital payment ecosystem, it has the power to capture a youth segment that has been more skeptical of traditional banks and credit cards than previous generations. These younger consumers currently account for 80 percent of BNPL transactions.

For emerging markets, BNPL has huge potential to introduce a younger generation to alternative financing while still providing a valuable service to markets with low credit card penetration and limited access to formal financial services among all age brackets. As many retailers move online for the first time across these emerging markets, brand loyalty and pandemic-fueled digital transformation can translate into more inclusive financial onboarding.

Supply-Side Setbacks

Though the opportunity seems obvious from a demand-side perspective, supply-side challenges like infrastructure and availability of e-commerce persist. While the appetite for both BNPL and e-commerce is on the rise globally, international players are seeing the emerging market opportunities as market specific, where the foundations required for BNPL are adequate.

Australian BNPL provider Zip recently expanded into Africa through its 24.7 percent acquisition of South Africa’s Payflex. While Zip and Payflex see a lot of opportunity for the South African market, they anticipate the expansion into other African markets to be a “very difficult uphill battle,” according to Jarred Deacon, Payflex’s Head of Growth. The company experienced 2000 percent growth last year in South Africa alone, though for the rest of Africa he cites the lack of e-commerce as the main barrier to entry, followed by weak credit infrastructure like access to data, scoring and credit bureaus.

Due to the issues of credit and low credit card penetration, alternative credit and lending companies have a unique competitive advantage in providing BNPL services across emerging markets, armed with the technological know-how to gather data and assess creditworthiness. But even those with experience in assessing credit risk have been met with capital requirement challenges.

The Nigerian digital bank Carbon recently launched a BNPL service called Carbon Zero, which enables customers to make purchases in installments with zero percent interest, though a percentage of the total purchase cost must be made upfront. “We do not believe that a firm without a track record of lending can provide a similar service, except if they have a significant amount of capital to burn,” Carbon’s CEO Chijioke Dozie said of the BNPL opportunity in Africa. Even Carbon, which has been lending digitally for a decade, is only able to make their Carbon Zero product available to the upper echelon of Nigeria who earn at least ₦200,000, or US$500, per month.

Egyptian digital lending platform Shahry has had a similar experience, limited by the amount of loan capital they are able to disburse, which is why they are currently raising funds to be able to meet the demand for its BNPL service. But these difficulties are felt most by local players, which is why governments must act quickly to unlock e-commerce and capital availability as well as more ubiquitous connectivity so that markets can readily have access to online shopping. Countries like Egypt and Vietnam have already adopted e-commerce action plans that help to reform the sector to build trust and attract investment to strengthen the supply-side foundation, which will play a vital role in ensuring that local firms can take advantage of the potent opportunity before international firms move in – many without capital constraints.

Another basic constraint for BNPL in emerging markets is network connectivity, particularly in rural areas. For example, in India, a country that is said to be one of the fastest-growing BNPL and digital payment markets due to its young and growing population, the government is working to confront this issue through regulation. The Reserve Bank of India has encouraged providers to develop offline solutions to serve unconnected populations in an effort to democratize access to digital financing solutions like BNPL.

BNPL as a Gateway to Financial Inclusion

Government policies and regulation will also be essential to building consumer trust and responsible growth of the sector, as discussed in a previous Mondato Insight. Consumer protection is a widespread criticism of BNPL, as the service may incentivize consumers to buy things they cannot afford, and this may be even more dangerous across emerging markets where levels of financial literacy and inclusion are already low.

And though it requires a more tailored and patient approach, integrating consumer education principles into BNPL services can help to make users more financially literate. Plentina, a Fintech startup in the Philippines, recently launched a BNPL service through its e-wallet platform that gamifies financial education in the first screens of their application.

“By introducing a financial literacy quiz into the app, we are hoping to change the mindset of the individual and encourage them to be more responsible, since Plentina is also responsible for giving its customers the right offers.The per capita income in the Philippines is very low, and so we need to be careful not to exceed the customer’s ability to repay and put them in a debt trap; it’s easy to offer a loan for a luxury item to any given person, but you have to consider whether the loan is right for them.”

Earl Valencia - Co-Founder, Plentina

Pay later offerings were traditionally reserved for larger ticket items, and now with BNPL targeting a wider range of products – from electronics to cosmetics — more customers are able to participate, particularly since the merchants have been willing to part with some of their margins to welcome new customers via BNPL, making the transaction more affordable for customers. As long as companies operate ethically to encourage consumer education and deter predatory practices, BNPL can serve as an onramp to credit products for those who have previously been un- or underserved by traditional financial services. Retailers and their loyalty programs can be used as treasure trove proxies for credit scoring, and companies like Plentina are building out credit algorithms that leverage retail loyalty program data. To date, Plentina has generated 10 million credit scores using alternative data sources, and as customers build credit history, they will be able to offer more advanced and diverse types of loans.

Similarly, Pine Labs subsidiary, Qwikcilver, is an end-to-end service provider in the prepaid and gift card space in India, the Middle East, Southeast Asia and, most recently, Australia and New Zealand; the company has found success in leveraging its last mile retail technology to facilitate BNPL services, serving customers across income levels who are looking for affordability by allowing them to leverage lines of credit for retail purchases. With increased digitization and smartphone penetration across their target markets, customers are hungry for solutions that enable online purchasing through no-interest alternative financing options.

“The already fast increasing adoption of technology has been accelerated by the global pandemic. With the increased number of internet users and growth in online purchases, Southeast Asia is experiencing a preference shift towards Pay Later due to the reduced cost barrier of purchase and structured repayments.”

Dheeraj Chowdhry, Chief Business Officer, Qwikcilver

Alternative credit providers are well positioned to compete in this space, as they have access to the technology and data to onboard and facilitate BNPL for those without formal financial services. Instead of battling for market share in heavily competitive developed markets, these companies that can provide BNPL to the middle 20 to 30 percent of the population, like Plentina and Qwikcilver, find themselves as market leaders – attracting retail partnerships, investor interest and funds, as well as speedy consumer uptake.

High Risk, High Reward

As large and small players alike jump on the BNPL bandwagon, the space will continue to become increasingly crowded in regions like North America and Europe. Studies show that as the demand for digital financing increases amid the pandemic, consumers are likely to continue to use digital payment methods as long as they continue to be more available, convenient and affordable – in both developed and emerging markets. Companies that can take advantage of the opportunity to capture underserved segments in predominantly emerging markets will be best positioned to outpace international tech giant competition and consolidation.

Emerging markets represent a significant chunk of this opportunity, but not without challenges. Tailored market-specific approaches to financial education and credit scoring require investment and patience, but both are necessary to ensure BNPL offerings are marketed and introduced responsibly. If this can be achieved, those investing in emerging markets can capture a rapidly growing market with the potential to graduate beyond retail purchases to more advanced financial services and deeper financial inclusion.

Image courtesy of Rupixen

Click here to subscribe and receive a weekly Mondato Insight directly to your inbox.

Is Gig Work Financially Sustainable?

Can Climate Fintech Lift Emerging Economies?