Regulation: The Secret Ingredient To Uganda’s Fintech Sauce?

~8 min read

The East African country of Uganda has historically played second or third fiddle to fintech giants Kenya to the east and even Tanzania to the south. In contrast to its other regional neighbors Rwanda, the Democratic Republic of the Congo, and South Sudan, however, Uganda’s private sector and regulators seem to have concocted a successful recipe to fostering fintech proliferation. Despite being in the headlines more often for Ebola than for digital finance and commerce, the country is attracting growing recognition for its innovative ecosystem from investors to market analysts and startups alike, leading some to wonder whether the country, if it maintains the same trajectory, could even emerge as the dark-horse fintech regional leader. So what’s Uganda’s fintech secret? Experts point to regulation that strikes the balance between providing guardrails and choking the flow of innovation — but can the supposed regulatory excellence of the Pearl of Africa continue to rise at pace with the ever-roiling fintech seas?

A Taste of Kampala

If you’re flying to Kampala, your first digital experience will likely be for a visa. If you’ve spent much time working in the continent’s lesser frequented DFC ecosystems like the Democratic Republic of the Congo, you are treated to a straightforward two-part process: application and payment. Credit card payments go through, but you can also pay through mobile money, a first signal of the depths at which financial technologies from the ‘top’ (Visa, Mastercard) and from the ‘bottom’ (USSD-based mobile payment processing) have been integrated into Uganda’s social fabric.

Inside Entebbe’s relatively small yet efficient airport, the first stop, as usual, is cash. The row of ATMs from various East African banks provides you with no unexpected surprises: no error messages, lack of cash or, worse, cards eaten. You whip out your phone and check Uber: the drivers are there, and they are competitively priced with the airport taxi men who greet you upon exiting. You are delivered to your abode with transactions executed both seamlessly and cashlessly.

You barely had to plan your logistics; the hassles and friction of traveling in developing countries of yesteryear? Seemingly a thing of the past.

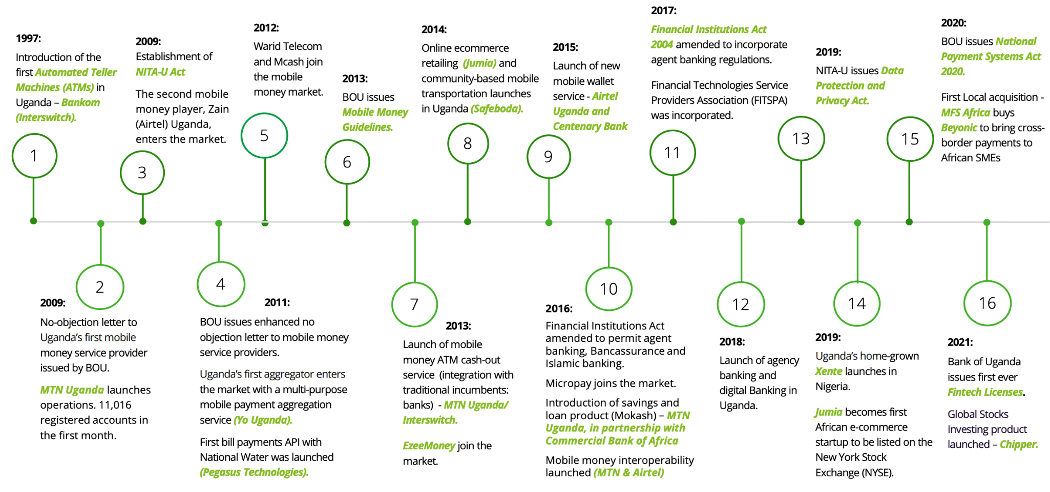

Source: Deloitte 2022, Study on the state of Uganda's Fintech Industry

That’s not to say it’s been all rainbows and butterflies; for months, your first Google hit on Uganda would yield anxious reports on the spread of Ebola, how many people have died, and, critically, how exposed is the heart of the Pearl: Kampala city and its greater metropolitan area.

And that’s to say nothing of COVID-19, which in Uganda resulted in significant and serious lockdowns with devastating economic effects on the formal and informal sector; a 2.1% drop in GDP growth in 2020, compared to only 0.2% in Rwanda (which also imposed serious COVID mobility restrictions), 0.1% in Kenya, and 1.8% in Nigeria. Only South Africa suffered more, with a deep 7% cut.

But today, the city’s economic prospects feel vibrant, and the social and economic brakes necessitated by virus management feel both comfortably light-touch while comfortingly nearby. And of course, health sensitization at the national level have added fuel to the digitization fire consuming an ever-larger share of daily financial transactions. Like Rwanda, Uganda opted for a swift and significant COVID-19 response, while neighbors Kenya and South Sudan went for partial lock-downs and Burundi and Tanzania essentially continued life as normal. A consequence of the night curfews, stay-at-home orders, closures of public transport, cancellation of school and public events (aside from better health outcomes) was a significant uptick in digital solutions uptake: Bank of Uganda statistics show that the value of mobile money transactions grew by 28.2% in 2020 compared to 2.9% in 2019.

Indeed, as Allan Ssemakula, Director Enterprise at Airtel Uganda opined recently on the COVID-induced digital transition: “Time may come where the balance in terms of scale between cash and digital payments might shift to 90 per cent digital payments.”

Sampling the Sauce

You wake up and attend to step #2: get local tech. Your foreign SIM, though equipped with an MVNO plan that offers you unlimited 2G data in a pinch, isn’t going to cut if for the full-speed fintech experience you are seeking. You call up a local colleague to register a local SIM in their name to get a new Android smartphone for $200. Between Airtel and MTN, you choose the latter and set up mobile money payments through a simple USSD interface.

Loading up your wallet is where the surprises come. You recognize Wave from the ultra-low fee waves it’s been making in Senegal; you are pleased to experience zero-fee transfers from your international bank card to your new MTN mobile money wallet. Wave charges 1% on the exchange rate, a welcome contrast to the average 5.7% in 2020, down from 7.7% in 2011. You load and reload hundreds of dollars into your account this way, and with a simple KYC verification, you are liquid up to 3,000 USD each month. In the Pearl of Africa, the digital world has become your oyster.

So equipped, your digital finance journey begins. You notice that in spite of Uganda’s seeming high-tech dominance, some basics remain wanting — above all, roads. Kampala’s physical infrastructure is in a state of dilapidation incommensurate to its relatively advanced digital ecosystem, and traffic slows to a daily crawl as cars and motorcycles ease their passengers and cargo gingerly across cavernous gaps that, at the wrong speed, are nothing less than life-threatening.

Yet life surges on. You download the SafeBoda app, a hometown hero in the Kampala digital finance space. Begun in Kampala in 2014, the interface works similarly to e-transport options like YegoMoto in Rwanda — except better. Drivers are trained drivers and navigate road chaos carefully and deliberately; their only challenge remains in actually using GPS technology many foreigners must rely on to navigate new lands. Common is the driver who will call you to ask your location rather than simply show up at your GPS pin, largely because they don’t necessarily trust their users to really ‘mean it’ that you’ll be where you say you’ll be when you say you’ll be there. A layer of personal, voice-to-voice communication thus remains a critical component to establishing the trust to transact digitally.

This holds for Jumia, Africa’s first tech unicorn. Place your order, and expect a call within 15 minutes, specifying items to replace with those out-of-stock, as well as your address in “local terms.” (“You know the King’s Farms? Slope down at the transformer and call again.”) Once you get the hang of it, however, you experience seamless delivery of home staples like fruits and vegetables, and delivery of local restaurant fare — authorized by nothing more than your mobile money PIN code.

You download Glovo, Jumia’s e-commerce competitor, and link your international credit card to compare. It’s equally flawless, with perhaps an even slightly more polished front-end. But the fundamental “rails” are accessible to anyone. As you gain familiarity with individual vendors, both personally and digitally, your transactions begin to migrate towards WhatsApp to make inquiries, browse, make orders and confirm receipts with screenshots and photos. You begin to pay your preferred Boda driver ‘off-platform’ this way; you order an ice cream cake delivery, some booze and maybe some controlled substances.

You head to a live-music show to enjoy the hospitality, strike up a conversation with a direct-to-farmer fertilizer marketing executive. “Tanzanians — sometimes they are too ‘chill’ for Ugandans when it comes to business. Kenyans, though — maybe a bit too cutthroat,” he says, overlooking the scene of well-to-do Ugandans enjoying a Friday night surrounded by loud music, brightly lit World Cup highlights, and a steady stream of bottles. “We are a gregarious people, we like to congregate. Somehow, everything works.”

Time: The Secret Ingredient?

If Uganda’s fintech sector has thrived, it certainly hasn’t done so overnight. The emergence of ‘base-layer’ mobile money technologies in 2009 mirrors that of its birthplace in Kenya, and several key notable regulatory actions have incubated the sector since, notably the Electronic Transactions Act of 2011 authorizing the use, security, facilitation and regulation of P2P transfers, electronic communications, and other online transactions. The recent National Payment Systems Act (NPSA), passed in 2020, separated telecommunications services from mobile money services, and it has since instituted the distribution of fintech licenses and a regulatory sandbox that have awarded at least 20 licenses to fintechs to carry out services under the NPSA, including companies like MTN Mobile Money, Airtel Money, Mcash, Micropay, Interswitch, Agent Banking Company, Chipper Cash, Dusu Pay, Eversend, Xente, Swepe2Pay, Beyonic and Yo Uganda.

Source: Deloitte 2022, Study on the state of Uganda's Fintech Industry

Kenneth Muhangi is a lecturer of intellectual property and ICT law and partner at KTA Advocates. He represents Uganda at the 4IR Portfolio Communities of the Centre for Fourth Industrial Revolution of the World Economic Forum, is an external advisor to the Ministry of ICT on innovation and ICT policy development and a consultant with the World Bank. He highlights the role of an evidence-based approach to regulation in Ugandan policy that has helped to cultivate its digital finance ecosystem.

“The National Payment Systems Act introduced a regulatory sandbox where a fintech provider can live-test a product within a parameter the Central Bank will advise on, allowing technologies or products not specifically covered by existing regulation to leverage the legal framework and operate legally. This allows the Bank to monitor developments and adjust accordingly.”

Kenneth Muhangi - Partner, KTA Advocates

Muhangi points to companies like Wave employing such sandbox opportunities to demonstrate the viability of new products like QR cards as a valid form of payment verification for users without a smartphone. While optimistic about Uganda’s fintech growth overall — highlighting its young, entrepreneurial and increasingly digital literate population — Muhangi would also like to see the regulatory framework more explicitly focus on the payments space, such as establishing a dedicated body like the regulatory authority devoted exclusively to microfinance.

“Between ‘move fast and break things’ and ‘don’t rock the boat,’ for Ugandan financial regulators, it’s a bit of everything. In the financial sector, very often it is ‘wait and see’ as a way to provide safeguards like capital reserve requirements while still allowing for financial innovations to be tested.”

Kenneth Muhangi - Partner, KTA Advocates

Sample Frequently

Fundamentally, technology regulation in Uganda appears to be thickening unevenly and unhurriedly. While mainstays of mobile money regulations have over a decade yielded some fintech-centric enabling legislation, regulators are not rushing to put the cart before the horse; they want to see impact before setting direction.

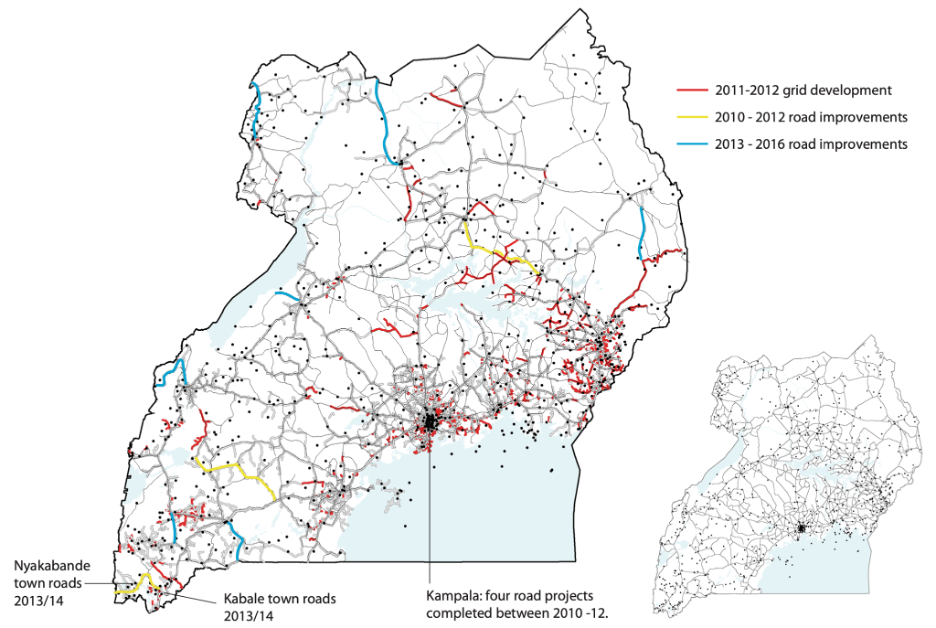

Fortunately, policy-makers’ toolkits for measuring, understanding and better targeting such impacts are getting ever more refined. Recent analysis published in Nature demonstrates how machine-learning models using satellite-based estimates of local community wealth can be used to evaluate the impact of specific policies more clearly than ever before. In that study, the effects of a single policy intervention — new electricity transmission lines built between 2011-2012 — were compared to areas without such improvements, finding that communities near the new lines experienced improvements in their economic livelihoods roughly double that of those further away.

Source: Nature, 2022

Such approaches are unique in their ability to shrink the waiting time between implementation and impact, offering particular promise for better targeting Uganda’s unbanked — a critical growth area for the growing fintech ecosystem. Call it efficient finance, outcomes-based or results-based: what it is is well-informed.

So what can regional neighbors learn from Uganda’s policy success? Measure, manage and adjust. The digital finance stew does not cook overnight — it takes a lot of care and nurturing, and many chefs in the kitchen. A willingness to let the sauce simmer and stew, all the while allowing a growing crowd of cooks and customers in to test, taste and season — such seems to be the secret to Uganda’s fintech recipe.

Image courtesy of Sam Miles

Click here to subscribe and receive a weekly Mondato Insight directly to your inbox.

FTX Aftershocks: Creation Through Destruction?

The Hurdles of Financing Africa’s Cross-Border Logistics Industry